VISA: We see Bitcoin & crypto assets as digital gold

Visa reveals crypto plans in Q2 2021 Earnings Call, plus other highlights this week

JPMorgan to enter Bitcoin, Visa reveals crypto plans, Gemini & Mastercard launch crypto credit card, EIB sells 2-year notes registered on Ethereum

Get the top crypto insights delivered to your inbox every week.

Quick Take:

Visa CEO, Al Kelly reveals crypto plans

JPMorgan to let clients invest in Bitcoin fund for the first time

Gaming giant Nexon purchases $100 million worth of Bitcoin

EIB sells two-year notes, registered on Ethereum

Gemini partners with Mastercard for a crypto credit card

Binance to launch its own NFT marketplace in June

SEC delays a decision on VanEck’s proposed Bitcoin ETF

Visa CEO, Al Kelly: We see bitcoin and crypto assets as digital gold

During Visa’s Q2 2021 Earnings Call this week, president and CEO Alfred Kelly laid out the payment giant’s long term vision for the crypto space. Kelly went on to say “there's two market segments as we see it. One is bitcoin, the kind of assets which are primarily held by people. We kind of think of them as the digital gold ... And then there are digital currencies, including CBDCs and stablecoins."

Kelly says there is 5 major opportunities for Visa:

1. Enabling consumers to buy crypto through Visa cards

"The first opportunity is enabling consumers to make a purchase of these currencies or Bitcoin and we're working hard with wallets and exchanges to just make sure we're facilitating acceptance in people's ability to use their Visa cards to buy."

2. Converting crypto to fiat at 70 million Visa merchants

"The second opportunity is enabling digital-currency cash-outs to fiat. So converting a digital currency to a fiat on a Visa credential, which then makes that -- those funds available for shopping at any one of the 70 million Visa merchants and gives immediate utility to the digital currency."

3. Enabling financial institutions & fintech partners to offer crypto

“Thirdly, is enabling financial institutions and fintech partners to be able to have a crypto option for their customers. So what we've done in this space is we've created APIs that enable financial institution customers to purchase, custody, or even trade digital currencies.”

4. Allowing financial institutions to settle crypto with stablecoins

“Fourth one is settlement. We've upgraded our infrastructure to allow a financial institution to settle with these in a digital currency with stablecoin, starting with USDC. As you know, today, we transact in 160 currencies every day, and we settle every evening in 25 currencies. So we're going to now be able to support digital currencies as an additional settlement currency on our network.”

5. Working with banks on CBDCs

“And then the fifth area of opportunity is just working with central banks. So we're talking to central banks about the criticality, though, of public-private partnerships, and in particular, the criticality of acceptance because for these central bank digital currencies, to have value, they're going to have to both be secure in the minds of consumers.”

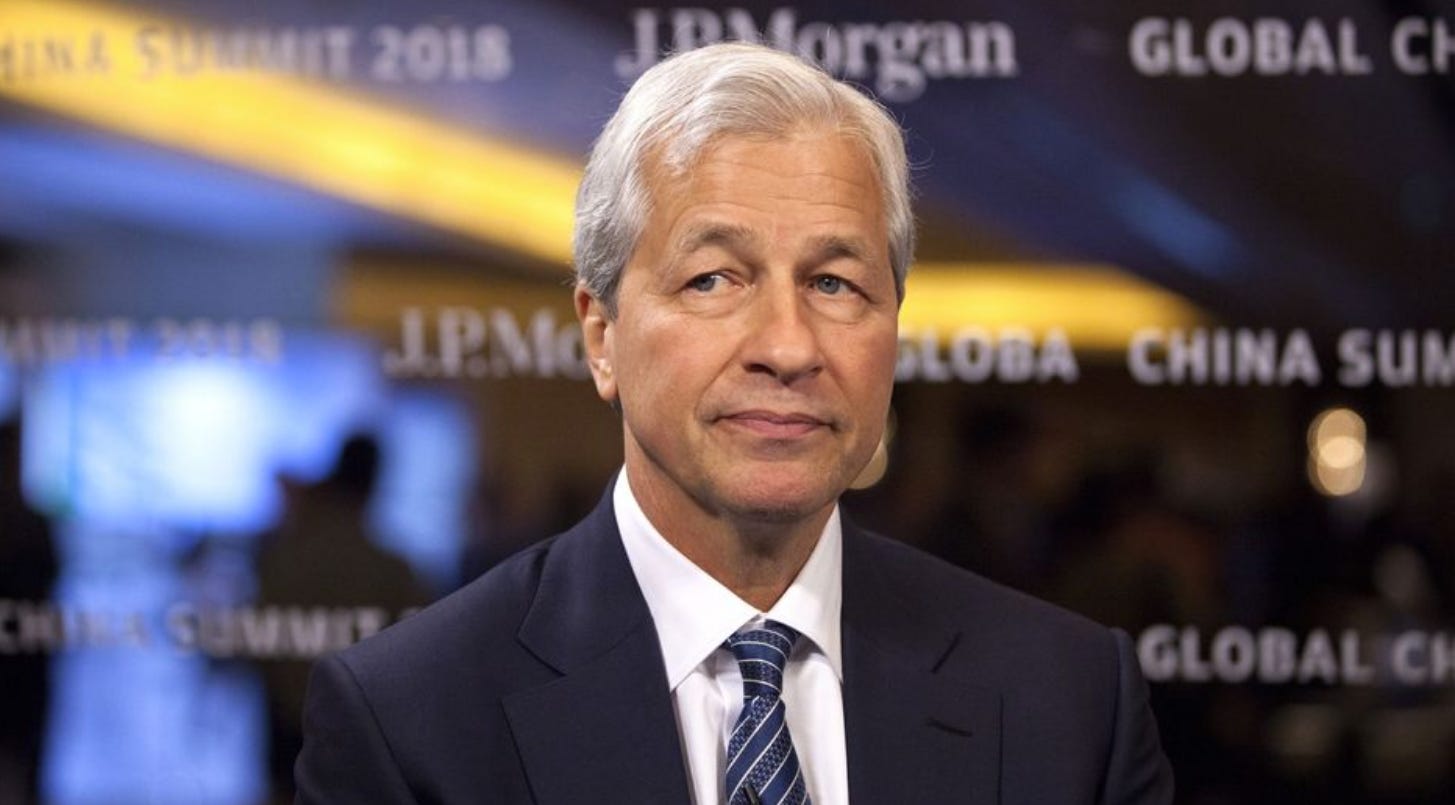

JPMorgan to let clients invest in Bitcoin fund for the first time

According to Coindesk, JPMorgan Chase is preparing to offer an actively managed Bitcoin fund to certain clients, becoming the latest, largest and unlikeliest U.S. mega-bank to embrace crypto as an asset class.

The JPMorgan bitcoin fund could roll out as soon as this summer, two sources familiar with the matter told CoinDesk. Institutional bitcoin shop NYDIG will serve as JPMorgan’s custody provider, a third source said.

Gaming giant Nexon purchases $100 million worth of Bitcoin

NEXON, a global leader in gaming announced on Wednesday the purchase of 1,717 bitcoins for approximately $100 million (¥11.1 billion) at an average price of approximately $58,226 (¥6,446,183) per bitcoin, inclusive of fees and expenses.

“Our purchase of bitcoin reflects a disciplined strategy for protecting shareholder value and for maintaining the purchasing power of our cash assets,” said Owen Mahoney, President and CEO of Nexon. “In the current economic environment, we believe bitcoin offers long-term stability and liquidity while maintaining the value of our cash for future investments.”

EU investment arm sells two-year notes, registered on the Ethereum network

The European Investment Bank sold 100 million euros ($121 million) of two-year notes in an inaugural sale of so-called digital bonds that harness the power of blockchain.

The notes have a zero percent coupon and will be registered on the Ethereum blockchain network after pricing Tuesday, according to information from a person familiar. The sale was managed by Goldman Sachs Group Inc., Banco Santander SA and Societe Generale AG, the person said.

More highlights:

Gemini to partner with Mastercard for a crypto credit card

US Bank to offer a crypto custody product this year

SEC delays a decision on VanEck’s proposed Bitcoin ETF

Binance says it plans to launch its own NFT marketplace in June

WisdomTree lists Ethereum ETP on Deutsche Borse’s Xetra

CME Group to launch Micro Bitcoin futures on May 3

That's it, you’re up-to-date

Thanks for reading Bloqport. Enjoyed today's newsletter? Feel free to share your thoughts on Twitter or forward this to a friend and get them to subscribe here.