The strongest stage of the bull market is coming

Blackrock & Goldman Sachs to enter crypto plus other highlights this week

Grayscale adds $2 billion worth of BTC in 30 days, Blackrock & Goldman Sachs to enter crypto, MetLife may soon buy Bitcoin, BTC whales at all time high

Total crypto market cap is $917B, down 8.16% over the last 24 hours

Quick Take:

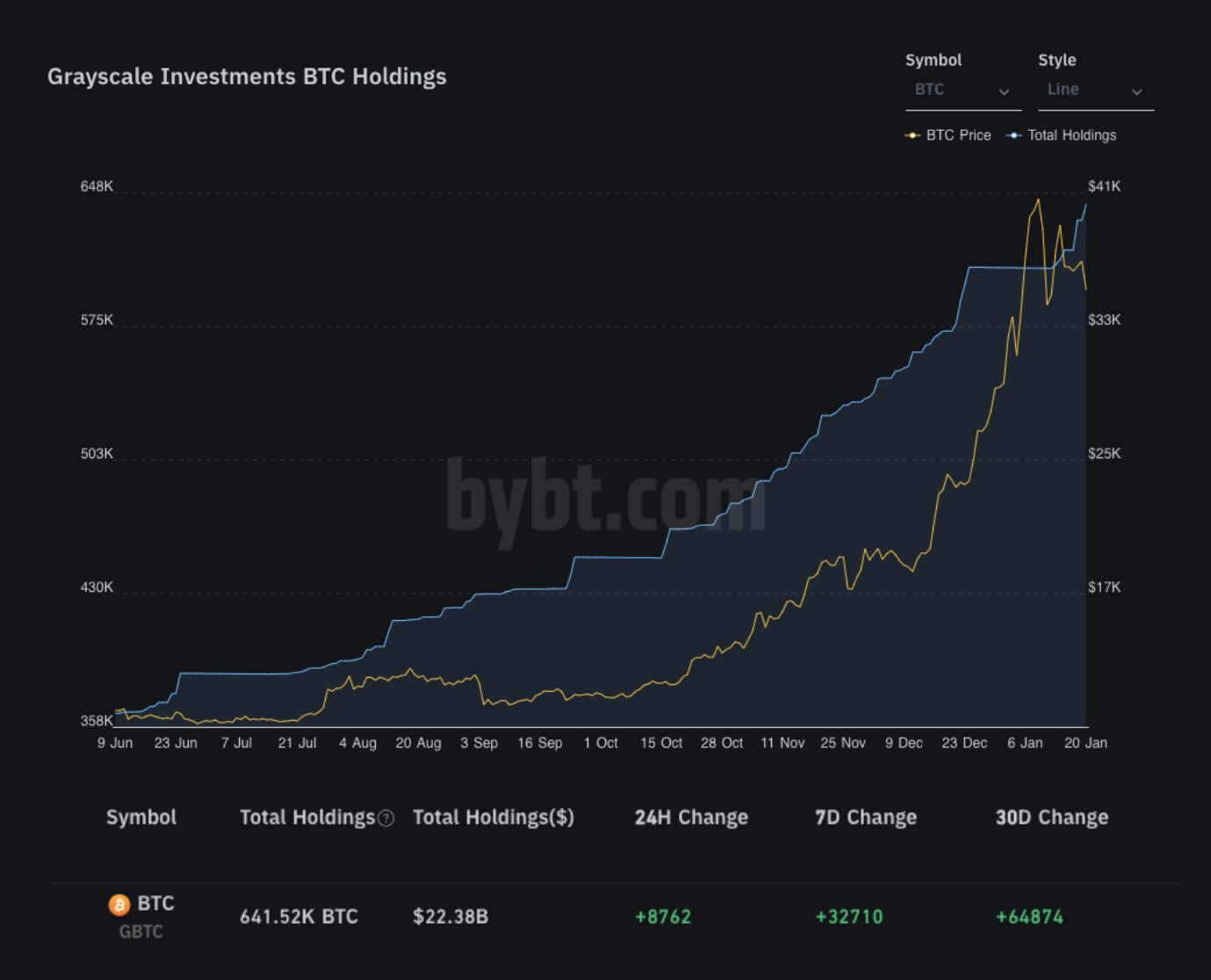

Grayscale adds $2 billion worth of BTC in 30 days

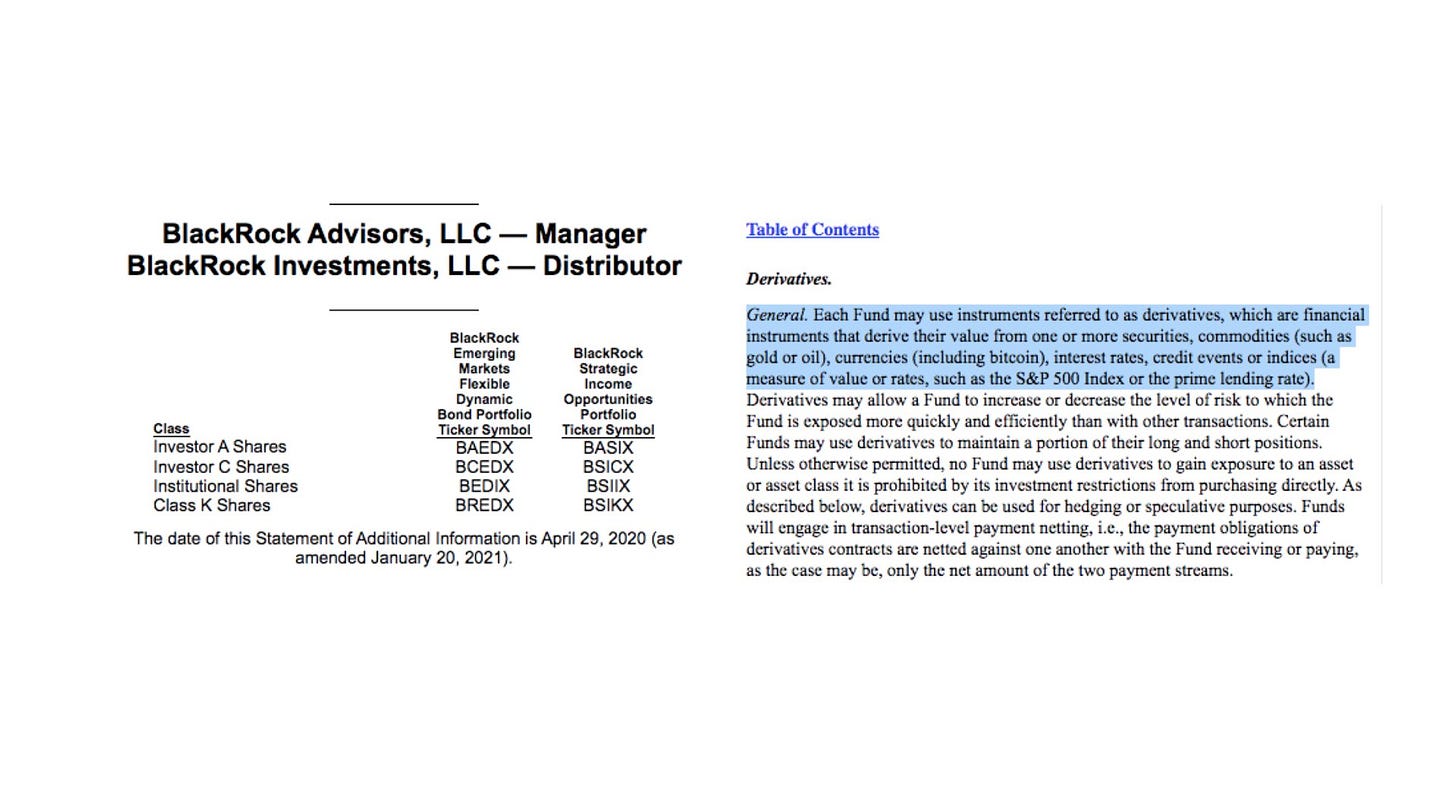

Blackrock to start Bitcoin futures trading

Number of Bitcoin whale addresses hits new all time high

Bitcoin’s liquidity is seeing historic depletion

The strongest stage of bull market is still yet to come

Over the past 30 days, Grayscale’s BTC holdings have increased by 64,874 BTC, worth $2.2 billion

Grayscale now holds approximately 4.4% of the remaining Bitcoin supply (assuming 4M BTC have been lost forever).

On Monday, JPMorgan said that inflows into the Grayscale Bitcoin Trust would need to maintain $100 million per day in order for Bitcoin to have a chance at reaching $40,000 again. Well, Grayscale did over half a billion dollars in BTC inflows in just one day this week.

On Monday, Grayscale added 6,244 BTC worth $590 million in a single day, which equates to 18X of the daily Bitcoin mined.

However, keep in mind that Grayscale also accepts Bitcoin. Therefore not all increases in their holdings may be fresh purchases. Still insanely bullish when we consider that theres a 6 month lock up period before investors can sell shares.

Grayscale also noted that 93% of Q4 inflows were from institutions.

Multi-trillion dollar asset manager, Blackrock, to start Bitcoin futures trading

The world's largest asset manager BlackRock with $7.8 trillion assets under management, may soon get exposure to Bitcoin futures, according to its Form 497 that was filed with the U.S. SEC yesterday.

The number of whale addresses holding 1,000 BTC just hit an a new all time high

Number of addresses holding 1,000 BTC just reached an a new all time high of 2,446. Over the last 21 days, 141 new whale address with over 1k BTC (together controlling around $6 billion) were created, suggesting large entities are expecting a significant price rise for Bitcoin in the near future.

Bitcoin’s liquidity is seeing historic depletion

In the past 30 days, around 60,000 BTC worth $2 billion has left exchange reserves for hot/cold storage. Also in the past 30 days, around 270,000 BTC worth $9.4 billion moved to entities considered strong long-term HODLers.

As Luke Martin points out, historically, bull cycles have ended after liquid supply change flips positive.

The strongest stage of bull market is still yet to come, here’s why

One of the strongest metrics for arguing that this bull cycle is still in its early stages is BTC’s market dominance. Bitcoin’s dominance has increased 16.46% since February 2020 and is still above 60%. In the previous bull run, we saw altcoins seize substantial market share as Bitcoin’s dominance dropped 62% between 2017 to early 2018 while retail investors chased alts.

This followed an 84% drop as weak hands FOMO’d in during the mania phase of the last bull market and then soon folded.

This cycle however has been largely driven by institutional demand who are hyper-focused on Bitcoin and Bitcoin only for the time being. When Bitcoin’s dominance beings to drop drastically, this could be an early sign of the cycle slowing down.

Bitcoin’s volatility is also still significantly lower than the last bull parabolic cycle which could indicate extremely bullish upside potential. The cofounder of Gold Bullion International, Dan Tapiero, warns that volatility typically spikes at the end of moves and, so far, it is near the lows. This implies that the most parabolic part of the Bitcoin surge is still yet to come.

Bitcoin has closed above $30k for 19 consecutive days, what’s next?

Well, realistically a healthy retrace is in order. The SOPR (Spent Output Profit Ratio) points to a potential re-tracement that could see a correction before another rally.

The SOPR indicator acts as a proxy for overall market profit and loss. By plotting the SOPR of all spent outputs combined, aggregated by the day in which they were spent, the graph below can be created.

A SOPR value of greater than 1 implies that people are, on average, selling at a profit (because the price sold is greater than the price paid). Likewise when SOPR is below 1, this implies that people would be selling at a loss.

Therefore, the SOPR oscillator could serves as a reliable marker for identifying local tops & bottoms. In a bull market, when SOPR falls below 1, people would sell at a loss, and thus be reluctant to do so. This pushes the supply down significantly, which in turn puts an upward pressure on the price, which increases. You can learn more about this indicator here.

More highlights:

Insurance firm MetLife, with $650 billion AUM, may soon buy Bitcoin

Bitcoin 'is here to stay’ says former U.S. Treasury Secretary

Goldman Sachs issue an RFI to explore crypto asset custody

Biden freezes Mnuchin’s proposal on “unhosted" crypto wallets

Bitfinex says it’s nearly done turning over documents to NYAG

Ethereum now settling $12 billion in daily transactions

That's it, you’re up-to-date

Thanks for reading Bloqport. Enjoyed today's newsletter? Feel free to tell us your thoughts on Twitter or forward this to a friend and get them to subscribe here.

Thanks for sharing!