MicroStrategy to buy more Bitcoin after $1 billion purchase

MicroStrategy to buy more Bitcoin plus other highlights this week

Bitcoin rebounds, what’s next? Tether settle with NYAG for $18.5M, ETH devs suggest July EIP-1559 upgrade launch, Coinbase valued at $100B, institutions are buying the dip

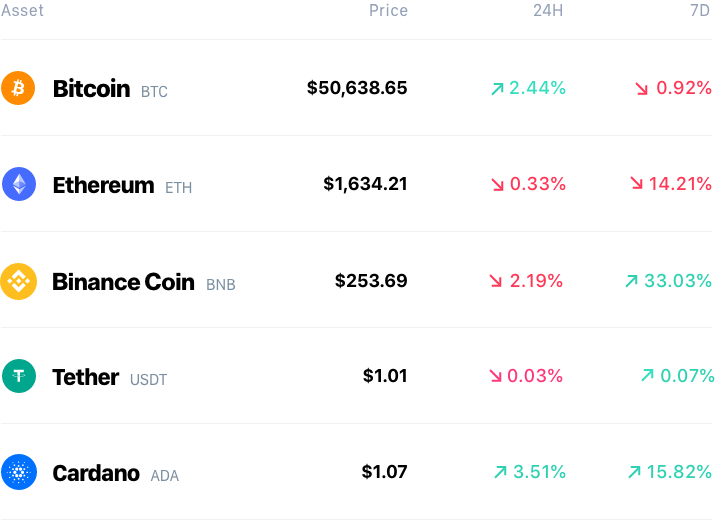

The total crypto market cap is $1.5T, up 2.3% over the last 24 hours

Get the top crypto insights delivered to your inbox every week.

Quick Take:

MicroStrategy buy $1B more Bitcoin

Square buy $170m more Bitcoin

Purpose Bitcoin ETF adds 9,647 BTC

Coinbase valued at $100 billion

Bitfinex, Tether settle with NYAG for $18.5 million

100-year-old Swiss bank to enable crypto trading

Bitcoin dropped 20%, should we be worried?

Square and MicroStrategy announced new Bitcoin purchases worth over $1 billion

Square announced on Tuesday that it has purchased 3,318 bitcoins for $170 million. Which means 5% of its total corporate cash is now in Bitcoin, worth a total of $394 million. In the firm’s Q4 2020 Shareholder Letter, Square revealed that in 2020, more than three million customers purchased or sold bitcoin on Cash App, and, in January 2021, more than one million customers purchased bitcoin for the first time.

MicroStrategy also announced on Wednesday that it had purchased an additional 19,452 Bitcoin for $1.026 billion, bringing their total holdings to 90,531 bitcoins. In the press release the firm also stated it would be continuing to purchase more:

"We will continue to pursue our strategy of acquiring bitcoin with excess cash and we may from time to time, subject to market conditions, issue debt or equity securities in capital raising transactions with the objective of using the proceeds to purchase additional bitcoin."

Coinbase's S-1 filing is now public, in preparation for a direct listing on Nasdaq

Coinbase’s S-1 filing with the Securities and Exchange Commission is now public. The filing reveals key insights in to the firm, most notably:

Coinbase made $322.3 million profit in 2020

62% of trading volume came from institutions in 2020

Coinbase made $1.1 billion in net revenue for 2020

43 million retail users, 7,000 institutions, and 115,000 ecosystem partners

2.8 million "transacting customers" as of the end of 2020

In less than a week since its launch, the Purpose Bitcoin ETF has added 9647 BTC

Less than a week after its debut, the Purpose Bitcoin exchange-traded fund is attracting large inflows of investor capital. In the last 5 days, the fund has acquired 9647 BTC, worth $497 million, a good indication that institutional interest in crypto assets is on the rise.

Bitcoin soared to $58,312 and then fell $7,000 in an hour, should we be worried?

After reaching a new all time high of $58,312 on Sunday, Bitcoin fell almost $7,000 in under an hour, causing extreme volatility. Glassnode noted that Bitcoin whales saw a supply increase in January of around +80,000 BTC and a subsequent decrease in supply of -140,000 BTC in February.

After its 20% decline from all-time highs this week, Bitcoin has risen above $50,000 again but should we be worried? Historically, Bitcoin goes through multiple steep corrections in during a bull run. Between 2016 to 2017, we saw at least six. On Nov 13 2017, Bitcoin hit a low of $5,844 then hit $20,000 thirty-four days later.

As whalemap notes, previous macro tops have occurred when thousands of transactions worth $5-$7 million dollars each were flooding the blockchain, a sign of strong FOMO. Currently, we’re nowhere near the historic limit of BTC transaction volume.

More highlights:

Bordier & Cie SCmA to enable crypto trading

Bitfinex , Tether settle with NYAG for $18.5 million

MoneyGram has 'suspended' use of Ripple's platform

ETH devs suggest EIP-1559 upgrade could launch in July

Chainlink launch scalability upgrade ‘Off-Chain Reporting’

Coinbase valued at $100 billion on Nasdaq Private Market

DEXs processed more than $120 billion in 2021 so far

Cardano’s ‘Mary’ protocol update confirmed for March 1 launch

That's it, you’re up-to-date

Thanks for reading Bloqport. Enjoyed today's newsletter? Feel free to share your thoughts on Twitter or forward this to a friend and get them to subscribe here.