Second-oldest bank in the US to start trading crypto this year

State Street to begin crypto trading plus other highlights this week

State Street to begin crypto trading, Grayscale to convert GBTC into Bitcoin ETF, Coinbase release Q1 figures, Fidelity, Square and Coinbase Launch Bitcoin Trade Group

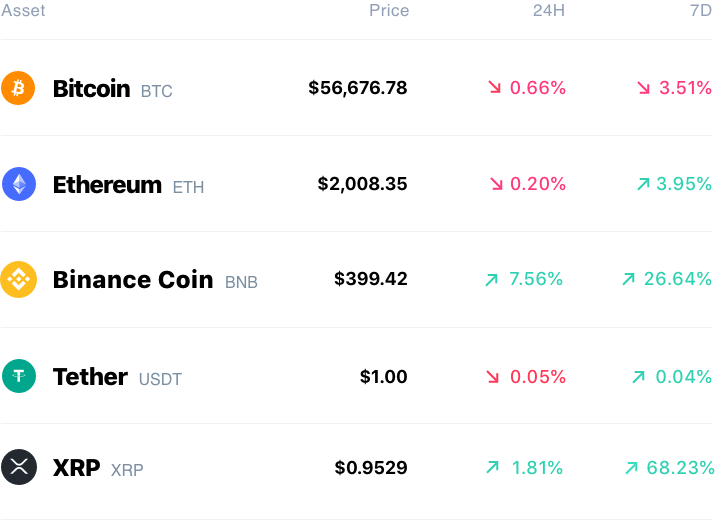

The total crypto market cap is $1.9T, up 2.2% over the last 24 hours

Get the top crypto insights delivered to your inbox every week.

Quick Take:

The second-oldest bank in the US to start trading crypto this year

Grayscale to convert GBTC into Bitcoin ETF

Coinbase’s release Q1 estimated results report

Fidelity, Square and Coinbase Launch Bitcoin Trade Group

Sacramento Kings to offer Bitcoin as salary to players

Chainlink added to Grayscale’s Digital Large Cap Fund

Peter Thiel Calls Bitcoin ‘a Chinese Financial Weapon’

State Street, the second-oldest bank in the US to start trading crypto this year

As FT reports, State Street, the second-oldest bank in the U.S. with $3.1 trillion in assets under management, announced a deal with Puremarkets, whereby its Currenex platform will provide its trading infrastructure to the Pure Digital platform.

“Currenex is thrilled to leverage our experience and expertise in the FX and digital asset trading marketplace to provide Pure Digital with robust technology and infrastructure for this exciting digital currency trading initiative,” commented Global Head of Execution Services for State Street, David Newns.

Further to this, State Street Bank & Trust and Pure Digital will reportedly use the platform to enable crypto trading for their clients by mid-year.

“Banks are telling us that they can’t ignore client demand for crypto assets and they realise it’s a market they need to get into,” said Lauren Kiley, chief executive of Pure Digital.

Grayscale to launch Bitcoin ETF

Earlier this week, Grayscale Investments announced its plans to transform Grayscale Bitcoin Trust (GBTC) into an exchange-traded fund. Since February, GBTC has continued to trade at a negative premium. Grayscale says they are now 100% committed to converting GBTC into an ETF:

“Today, we remain committed to converting GBTC into an ETF although the timing will be driven by the regulatory environment. When GBTC converts to an ETF, shareholders of publicly-traded GBTC shares will not need to take action and the management fee will be reduced accordingly. With Canada approving Bitcoin ETFs earlier this year and the likes of Fidelity recently joining the race, the time seems ripe for Grayscale to finally revamp GBTC.”

Coinbase’s release Q1 estimated results report ahead of IPO next week

Coinbase has announced estimated earnings results for the first quarter ahead of its planned listing on the Nasdaq stock exchange later this month. In the three-month period ending March 31, 2021, Coinbase said it generated estimated revenue of $1.8 billion with a net income of approximately $730 million to $800 million.

Other metrics of interest include:

Coinbase has 56 million verified users and 6.1 million monthly transacting users.

Platform assets reached $223 billion, up from $90.3 billion at the end of 2020, and represent 11.3 percent of the total market value of all cryptocurrencies.

Coinbase said trading volume reached $335 billion, compared to $193.1 billion at the end of the previous quarter, per its S-1 filing with the SEC.

Coinbase plans to list its shares directly on the Nasdaq under the ticker COIN on April 14.

Fidelity, Square and Coinbase Launch Bitcoin Trade Group

As WSJ reports, Fidelity Investments, Square Inc., Coinbase and several other financial firms are forming a new trade group that aims to shape the way bitcoin and other cryptocurrencies are regulated.

The Crypto Council for Innovation will lobby policy makers, take up research projects and serve as the burgeoning industry’s voice in championing the economic benefits of digital currencies and related technologies.

More highlights:

Total crypto market reaches $2 trillion for the first time ever

Sacramento Kings to offer Bitcoin as salary to players

Peter Thiel Calls Bitcoin ‘a Chinese Financial Weapon’

Miami collaborating with Eth devs to put city services on blockchain

Chainlink added to Grayscale’s Digital Large Cap Fund

The Miami Heat enters into a long-term partnership with FTX

That's it, you’re up-to-date

Thanks for reading Bloqport. Enjoyed today's newsletter? Feel free to share your thoughts on Twitter or forward this to a friend and get them to subscribe here.