Bitcoin soared 120% the last time this happened

Ray Dalio's Bridgewater may soon buy Bitcoin, plus other highlights this week

Nasdaq-listed company buys $150 million Bitcoin, Grayscale entering DeFi? Marc Cuban: Bitcoin’s upside is truly unlimited, Harvard, Yale, Brown endowments buy Bitcoin, BTC futures funding rates dips below zero

The total crypto market cap is $951B, up 8.16% over the last 24 hours

Quick Take:

Marathon buys $150m of Bitcoin

Ivy league universities endowments have been buying crypto

Grayscale incorporates 12 new trusts

Billionaire Marc Cuban says Bitcoin’s upside is truly unlimited

Crypto whales have been accumulating heavily

BTC dips, altcoins boom

Is this Bitcoin correction finally coming to an end?

Nasdaq-listed company, Marathon Patent Group, announced that it has purchased 4,812 BTC for around $150M

On Monday, Marathon Patent Group, Inc., one of the largest enterprise Bitcoin self-mining companies in North America, announced that it has purchased 4,812.66 BTC for $150 million.

“We believe [Bitcoin] to be the de facto investment choice for individuals and institutions who are seeking exposure to this new asset class. We also believe that holding part of our Treasury reserves in Bitcoin will be a better long-term strategy than holding US Dollars, similar to other forward-thinking companies like MicroStrategy,”

Harvard, Yale, Brown Endowments have been buying Bitcoin for at least a year

Some of the largest university endowment funds in the U.S. have been quietly buying Bitcoin and crypto for the past year through accounts held at Coinbase and other exchanges. “A lot of endowments are allocating a little bit to crypto at the moment.” said a source. The smart money is quite literally buying Bitcoin.

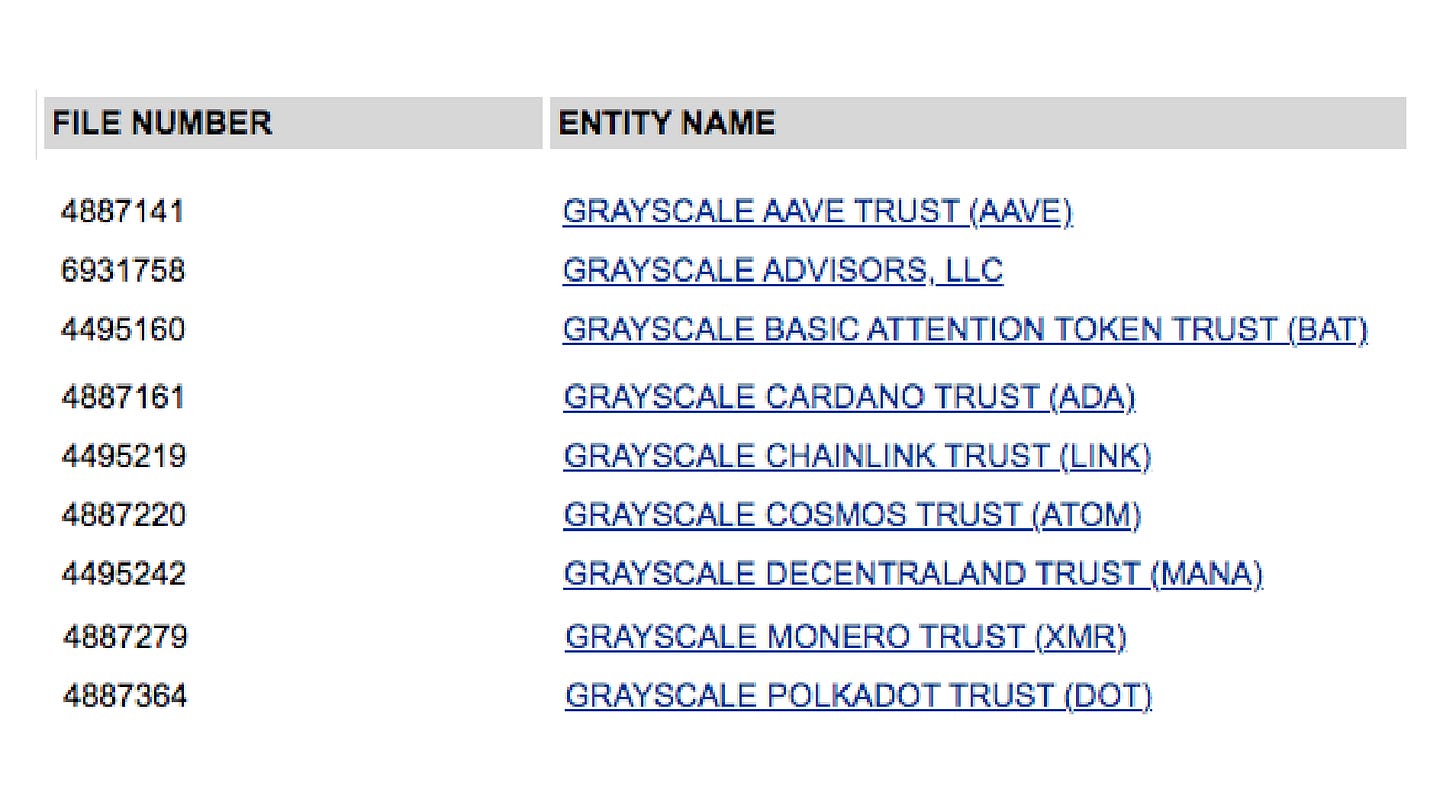

Grayscale incorporates 12 new trust including those tied to Polkadot, Aave, Cosmos, Chainlink, Tezos and Cardano

According to recent filings, Grayscale may be gearing up to launch a new suite of crypto funds. Over the past week, they incorporated twelve more trusts, including those tied to Chainlink, Tezos, Basic Attention Token, Polkadot, Aave, Monero and Cardano to name a few.

As the world's largest digital asset manager, Grayscale is more than capable of attracting major institutional investment to its trusts but keep in mind that these are just filings and they are not guaranteed. "Occasionally, we will make reservation filings, though a filing does not mean we will bring a product to market." says CEO ,Michael Sonnenshein.

Ray Dalio says his firm Bridgewater Associates may soon buy Bitcoin

Bridgewater Associates founder Ray Dalio said Bitcoin is “one hell of an invention” and he’s considering cryptocurrencies as investments for new funds offering clients protection against the debasement of fiat money.

“I and my colleagues at Bridgewater are intently focusing on alternative storehold of wealth assets... and Bitcoin won’t escape our scrutiny.”

Billionaire Marc Cuban says Bitcoin is a 'store of value’ and that he likes Ethereum

In an interview with Coindesk today, billionaire Mark Cuban says he thinks Bitcoin “is a store of value” and that he likes Ethereum. “The upside is truly unlimited. It is a platform for any number of amazing applications that outperform their traditional finance counterparts.”

Cuban previously told Wired he would "rather have bananas than bitcoin," because at least as food, bananas have intrinsic value.

Altcoins have been making all time highs during Bitcoin’s recent sell-off

Bitcoin and Ethereum whale addresses have been growing over the past month

The number of addresses holding 1,000 BTC just reached a new all time high of 2,450. Over the last 28 days, 140 new whale addresses with 1,000 BTC were created, suggesting large entities may be expecting a significant price rise for Bitcoin in the near future. Bitcoin held on exchanges has also dropped 2.4% over the past 30 days, with 37,626 BTC worth $1.19 billion leaving exchanges.

The number of whale addresses holding 10,000 ETH just reached a 13-month high. Since the beginning of the year, 35 new ETH whale addresses have been created, controlling $447 million combined. ETH balance on exchanges has also reached a 15-month low, dropping 16% over the past month.

Bitcoin futures funding rates across every major exchange dipped below zero

Bitcoin futures funding rates across every major exchange dipped below zero indicating that this correction may be coming to an end.

A perpetual swap contract is a futures contract that doesn't expire and therefore buyers and sellers must pay a funding rate every 8 hours. The funding rate is a mechanism to ensure that perpetual futures contracts are as close to the index price as possible.

When the funding rate is high, it means in order to use leverage to go long, you must pay a fee to people who are short.

When the funding rate for Bitcoin is negative, it means that short traders are incentivising long positions.

In simple terms, when the funding rate is positive, longs pay shorts. When the funding rate is negative, shorts pay longs. Around the last time this happened in December, Bitcoin soared 120% from 18,800 to 41,700 in 26 days.

Note: The mean Funding Rate across exchanges is an average of each exchange's funding rate weighted by the Open Interest of the corresponding exchange.

More highlights:

Galaxy Digital to launch a suite of ETH funds for institutional investors

Bitcoin bull Chamath Palihapitiya is running for California Governor

Bank of Singapore: Bitcoin “could replace gold as a store of value”

BlackRock CEO: Bitcoin “could be another store of wealth”

That's it, you’re up-to-date

Thanks for reading Bloqport. Enjoyed today's newsletter? Feel free to share your thoughts on Twitter or forward this to a friend and get them to subscribe here.

Thanks for the infos. Quality content as always!

Good job!