Bitcoin trust on track to surpass the world's largest gold ETF

Bitcoin sees record fund inflows plus other highlights this week

GBTC to surpass GLD, Gensler confirmed as SEC Chair, Ethereum Berlin upgrade goes live, crypto meets Wall Street

Get the top crypto insights delivered to your inbox every week.

Quick Take:

GBTC on track to surpass the world's largest gold ETF

Gary Gensler confirmed as SEC Chair

Coinbase closes first day on $85.7 billion valuation

Ethereum Berlin upgrade goes live

TIME magazine to hold Bitcoin on balance sheet

Tech firm Meitu invests $100 million in to crypto assets

Chainlink and Polkadot referenced in report by European Central Bank

Insurance giant AXA Switzerland allows customers to pay in bitcoin

Grayscale Bitcoin Trust on track to surpass the world's largest gold ETF

Grayscale Bitcoin Trust (GBTC), the largest Bitcoin pegged fund is on track to surpass the world's largest gold-pegged ETF, SPDR Gold Trust (GLD) over the coming months.

The Grayscale Bitcoin Trust has now reached $40.8 billion in assets, which would rank it in the top thirty of all exchange traded funds by assets if GBTC were an ETF.

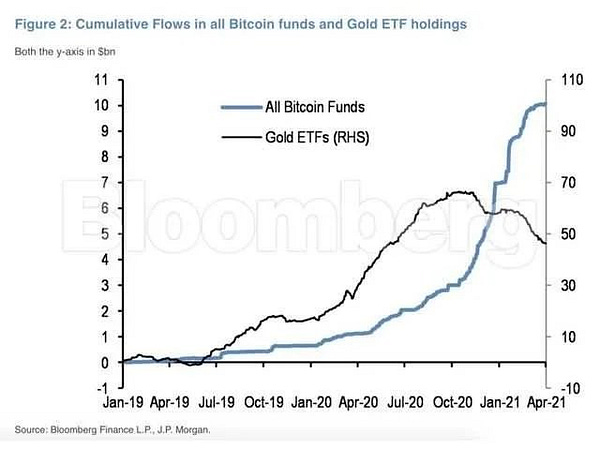

The growing popularity of Bitcoin over the past 3-4 months has seen institutional investors begin to choose Bitcoin over gold, with the benchmark cryptocurrency catching the attention of Wall Street giants and Fortune 500 companies.

A significant portion of outflows from gold ETFs over the past year have moved into Bitcoin according to JPMorgan. Gold ETFs have seen $20 billion in fund outflows since mid-October, compared to $7 billion in bitcoin fund inflows over that same time period.

Gary Gensler confirmed as SEC Chair

Gary Gensler has been confirmed as the new chair of the Securities and Exchange Commission (SEC), after a 53-45 vote by the U.S. Senate on Wednesday.

As SEC Chair, Gensler have will have authority to help define regulations addressing the cryptocurrency industry – or determine how existing regulations should apply.

During a confirmation hearing held by the Senate Banking Committee last month, Gensler said:

“Bitcoin and other cryptocurrencies have brought new thinking to payments and financial inclusion, but they’ve also raised new issues of investor protection that we still need to attend to,”

“If confirmed at the SEC, I’d work with fellow commissioners to both promote the new innovation, but also at the core to ensure investor protection.”

Coinbase closed on its first day of trading at $328.28, with $85.7 billion valuation

Coinbase shares closed at $328.28 on their Nasdaq debut, giving the exchange an initial market cap of $85.8 billion on a fully diluted basis.

Coinbase’s market cap exceeded $100 billion after its debut Wednesday morning, though the stock fell abruptly later in the day.

But recent volatility aside, Coinbase's public debut marks a watershed moment for the entire cryptocurrency space, reflecting the industry’s ascent into the mainstream.

"This is the beginning of what I consider the new financial system. Coinbase is the leader here in building this new financial system. Clearly, it's evolved to a point where there's no turning back," Ross Gerber, president and CEO at Gerber Kawasaki Wealth and Investment Management, told Yahoo Finance. "This is just a momentous moment for the crypto business and industry, and finance in general, as an entirely new set of leaders.

Ethereum Berlin upgrade goes live

The Berlin upgrade went live today on the Ethereum mainnet at block# 12_244_000. The upgrade incorporates four Ethereum Improvement Proposals (EIPs) to enhance the performance of the network and also prepare it for future upgrades:

Lowers the cost of the

ModExp (0x00..05)precompile;

EIP-2929: Gas cost increases for state access opcodes

Increases gas cost for

SLOAD,*CALL,BALANCE,EXT*andSELFEDESTRUCTwhen used for the first time in a transaction;

EIP-2718: Typed Transaction Envelope

Introduces a new transaction type that is an envelope to enable easier support for multiple transaction types;

EIP-2930: Optional access lists

Adds a transaction type which contains an access list, a list of addresses and storage keys that the transaction plans to access. This mitigates some of the gas cost increases introduced by EIP-2929.

While this upgrade may not be a drastic improvement and also does not include EIP-1559, it should at the very least slightly reduce transaction fees.

More highlights:

TIME magazine to reportedly hold Bitcoin on balance sheet

Novogratz’s Galaxy Digital files for a Bitcoin ETF

Billionaire Daniel Loeb’s hedge fund Third Point investing in crypto

Tech firm Meitu reaches its goal to invest $100 million in to crypto assets

Insurance giant AXA Switzerland allows customers to pay in bitcoin

Chainlink and Polkadot referenced in report by European Central Bank

That's it, you’re up-to-date

Thanks for reading Bloqport. Enjoyed today's newsletter? Feel free to share your thoughts on Twitter or forward this to a friend and get them to subscribe here.